Navigating the Complexities of Designated Person Compliance: Meeting SEBI Requirements with Confidence

Learn how to navigate the complexities of designated person compliance as per SEBI requirements with confidence

Technology solutions and how we integrate intelligent design - expert articles, news, snippets, testimony, product updates.

EXPLORE TOPICS

Affinis (32) Affinis FAQs (40) Compliance (15) ETT (7) FAQs (40) Insider Trading (34) SDD (22) SEBI (28) Structured Digital Database (21) UPSI (24)

Learn how to navigate the complexities of designated person compliance as per SEBI requirements with confidence

Pre-clearance procedures are essential to protect your organization from the ill-effects of insider trading but optimizing pre-clearance processes is a huge challenge without the right tool set.

Preventing insider trading is critical for maintaining the integrity of capital markets By mandating the pre-clearance process, SEBI sends a clear message that insider trading will not be tolerated. These regulations demonstrate the importance of ethical business practices to maintain market integrity and investor confidence.

Trading window closure processes are critical to the management of compliances for preventing insider trading. Learn about regulations and frameworks from SEBI.

Structured Digital Database Software clarified for market participants by ICSI and SEBI experts under the SEBI (Prevention of Insider Trading) Regulations.

Structured Digital Database Software clarified for market participants by ICSI and SEBI experts under the SEBI (Prevention of Insider Trading) Regulations.

Discover the global regulatory efforts aimed at combatting insider trading and dive into some of the most riveting cases globally.

Discover the regulatory efforts aimed at combatting unethical Insider Trading behavior and insider trading breaches. Dive into some of the most riveting cases in India and the consequences of non-compliance.

Designated persons are those connected with the company and reasonably expected to have access to unpublished price-sensitive information or UPSI for that company and comes with several compliance obligations... read on for full details.

UPSI means Unpublished Price Sensitive Information. That is valuable. And I was not permitted to use it because of Insider Trading Regulations; that's just silly nonsense (a fictionalized account of an insider)

Insider trading - Discover the top 5 Insider Trading Litigations In India; learn about regulatory efforts to combat unethical conduct and breaches of insider trading laws.

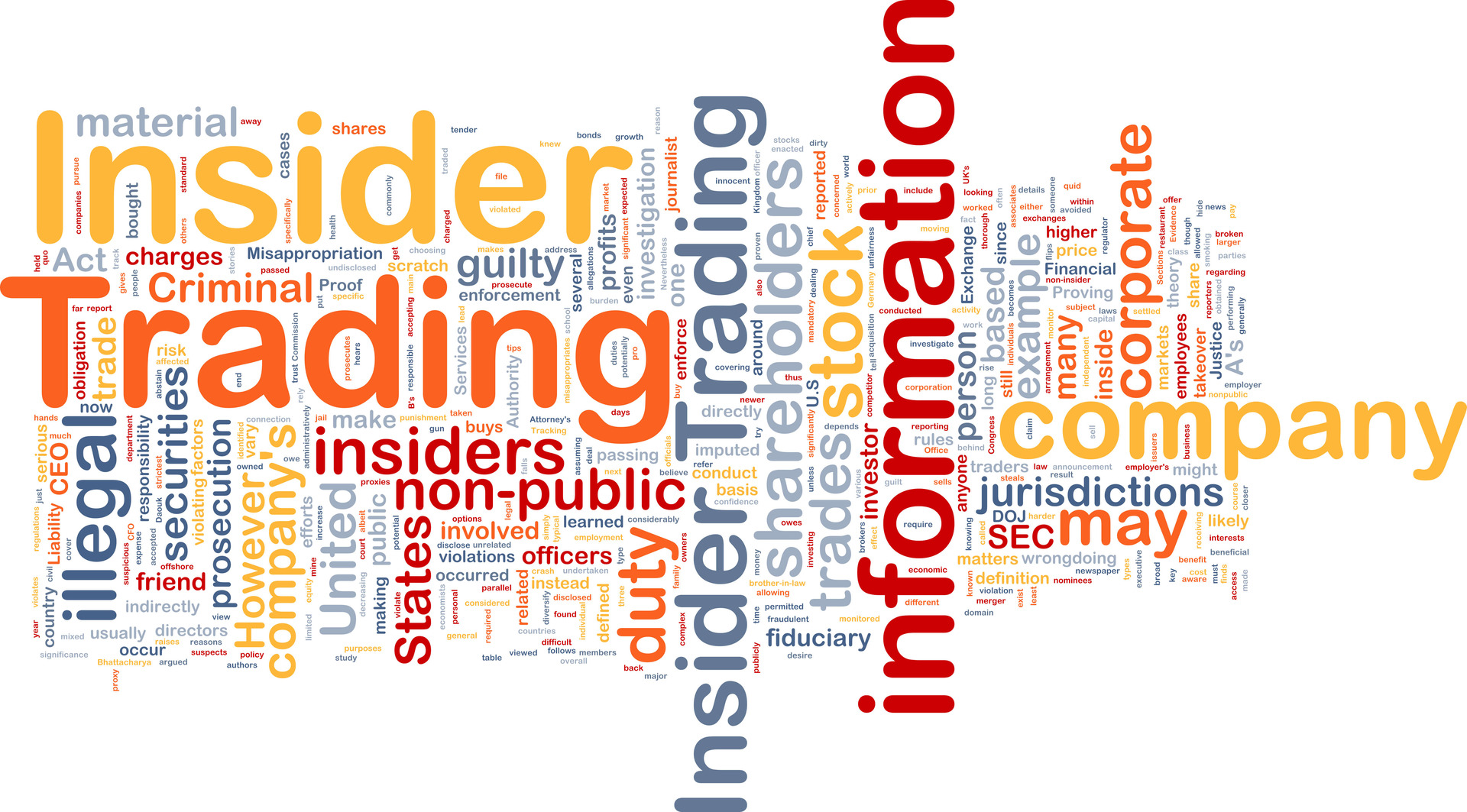

Insider trading is a major concern for market regulators because it can seriously damage the trust and stability of capital markets. This post explores the ways in which insider trading hurts capital markets, from undermining market confidence to encouraging unfair practices. Read on to know more

The Structured Digital Database Compliance Certificate is an essential part of the SEBI(PIT) compliances for Insider Trading. This blog post provides an overview of Compliance Certification for Structured Digital Database (SDD). Read on to learn more about the SDD Compliance Certificate.

Insider Trading Basics 101; What is it, why it is illegal, what type is legal and what the consequences can be.

The Week announces the launch by Jonosfero International of AFFINIS© (SDD), the Structured Digital Database that has been designed specifically ... [...]

Structured Digital Database, UPSI and Designated Persons have taken a large share of the limelight. These arise from the requirements of the SEBI (Prevention of Insider Trading Regulations); let’s take a look at how these regulations themselves arose.