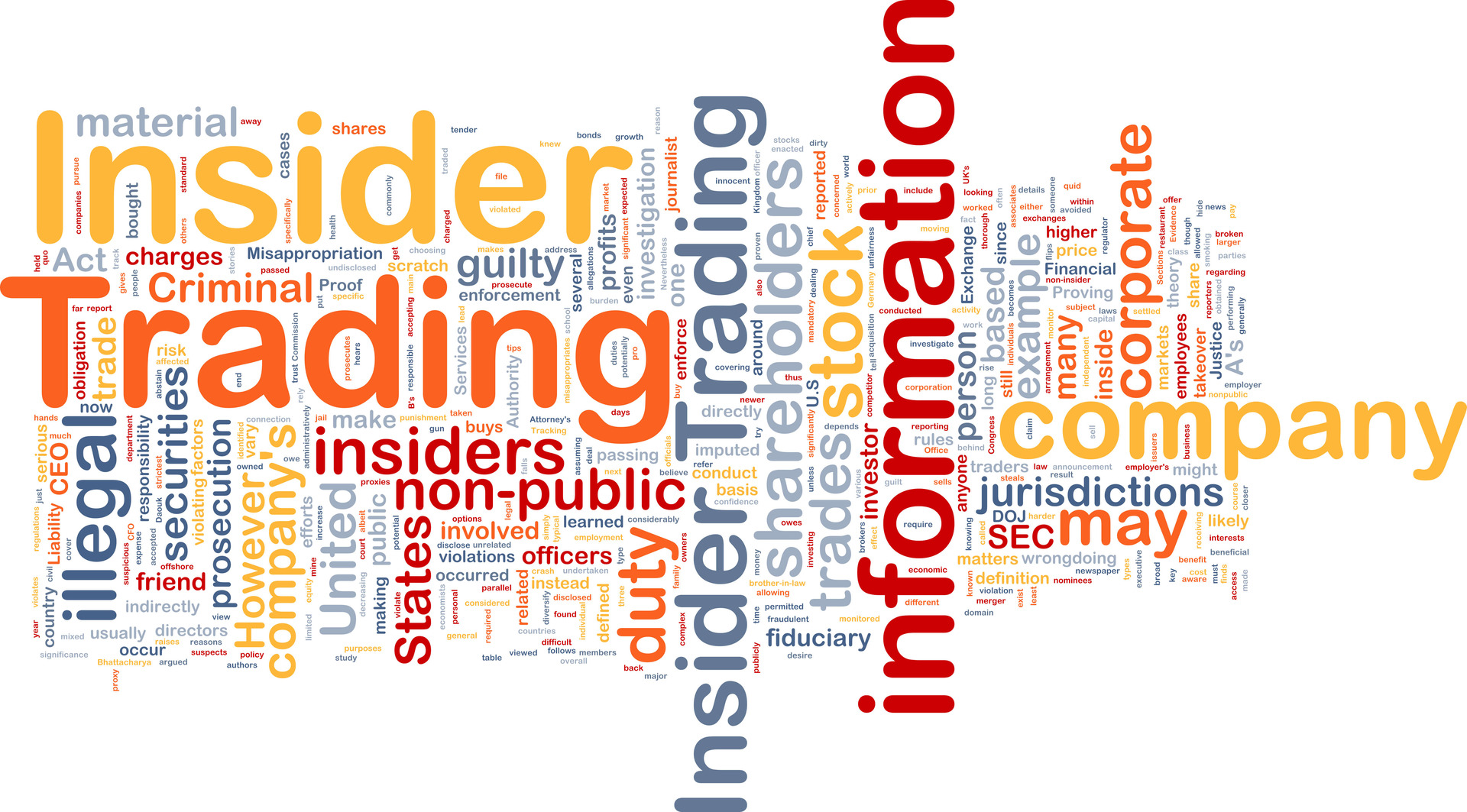

Trade Pre-Clearance and Insider Trading Prevention

Preventing insider trading is critical for maintaining the integrity of capital markets By mandating the pre-clearance process, SEBI sends a clear message that insider trading will not be tolerated. These regulations demonstrate the importance of ethical business practices to maintain market integrity and investor confidence.